Semimonthly payroll calculator

For the cashier in our example at the hourly wage. Discover ADP Payroll Benefits Insurance Time Talent HR More.

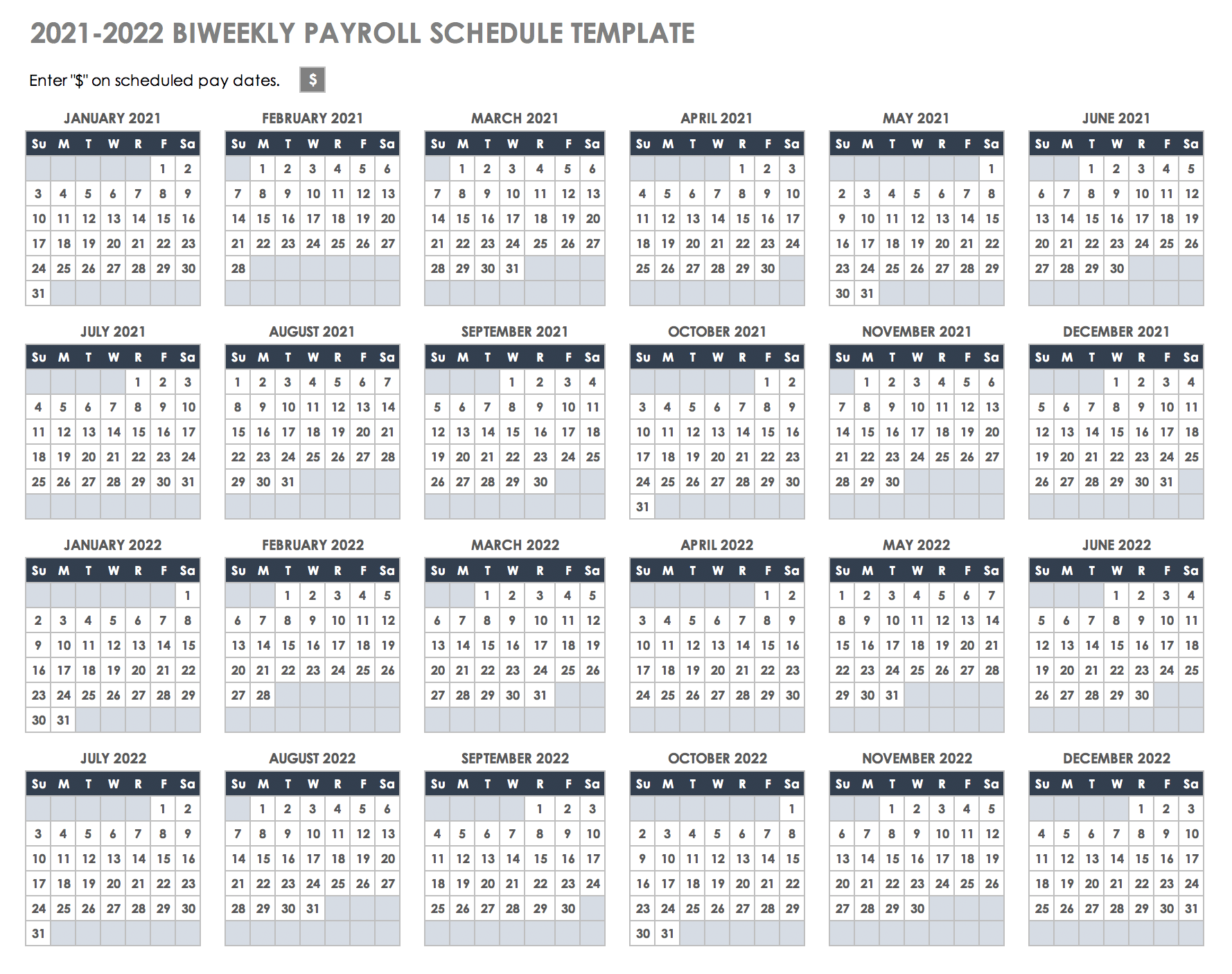

15 Free Payroll Templates Smartsheet

Ad Accurate Payroll With Personalized Customer Service.

. 1500 per hour x 40 600 x 52 31200 a year. Salaries are divided into 24 pay. Content updated daily for semi monthly payroll calculator.

Semimonthly payroll produces 24 consistent paychecks per year. Get a free quote today. Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as.

You can use the calculator to compare your salaries between 2017 and 2022. All other pay frequency inputs are assumed to. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The calendar year has 2080 hours 40 hours x 52 weeks which includes paid time off such as vacation and holidays. The calculator is updated with the tax. Compare the Best Now.

Free Unbiased Reviews Top Picks. Affordable Easy-to-Use Try Now. These items must be received by the payroll office on or before the due date indicated above in order to be paid on the designated pay date.

Ad Process Payroll Faster Easier With ADP Payroll. On a semimonthly schedule the employees gross pay per paycheck would be around 229167. Get Started With ADP Payroll.

Dividing the total yearly salary by 12 will give you the gross pay for each month. Get a free quote today. Ad Process Payroll Faster Easier With ADP Payroll.

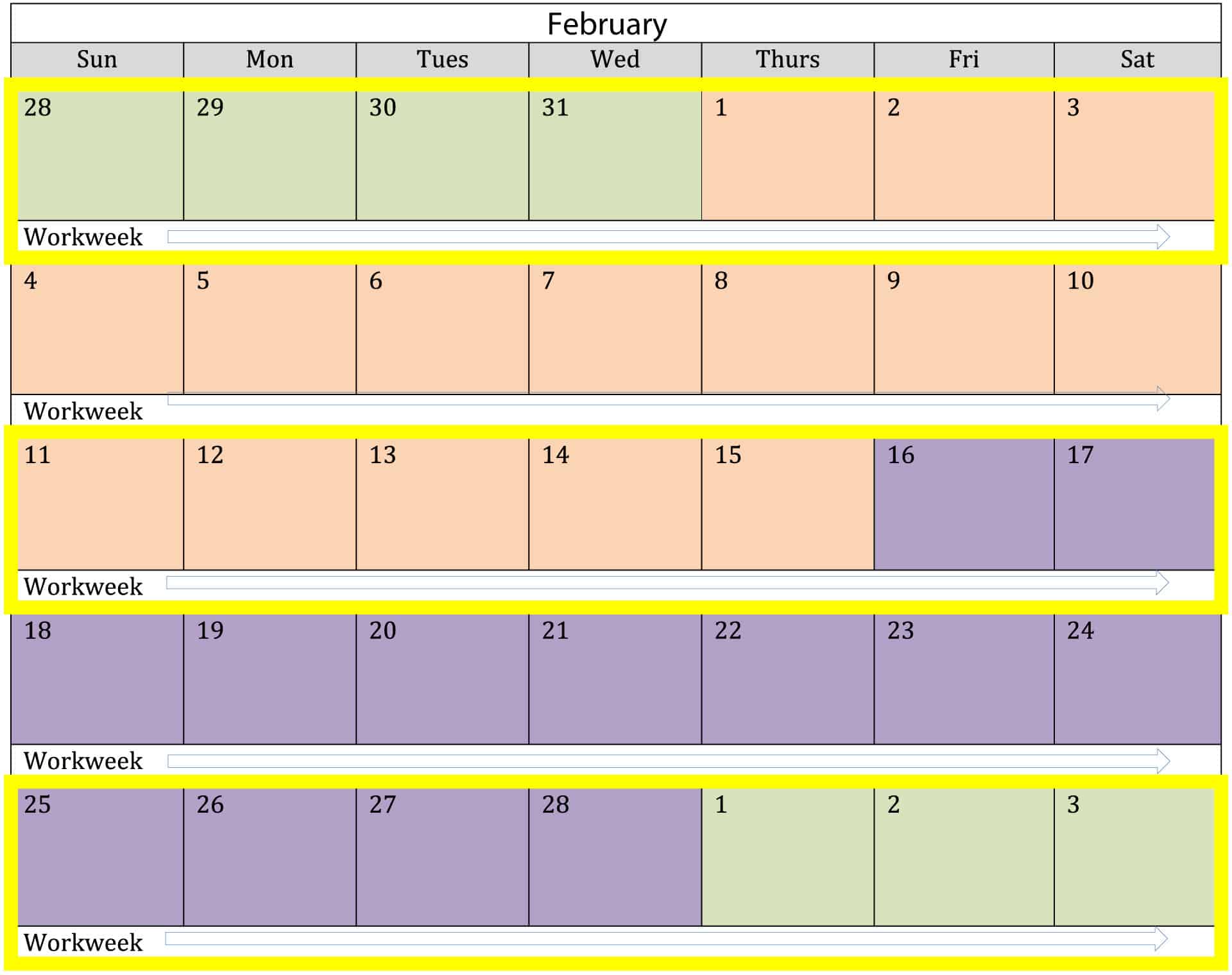

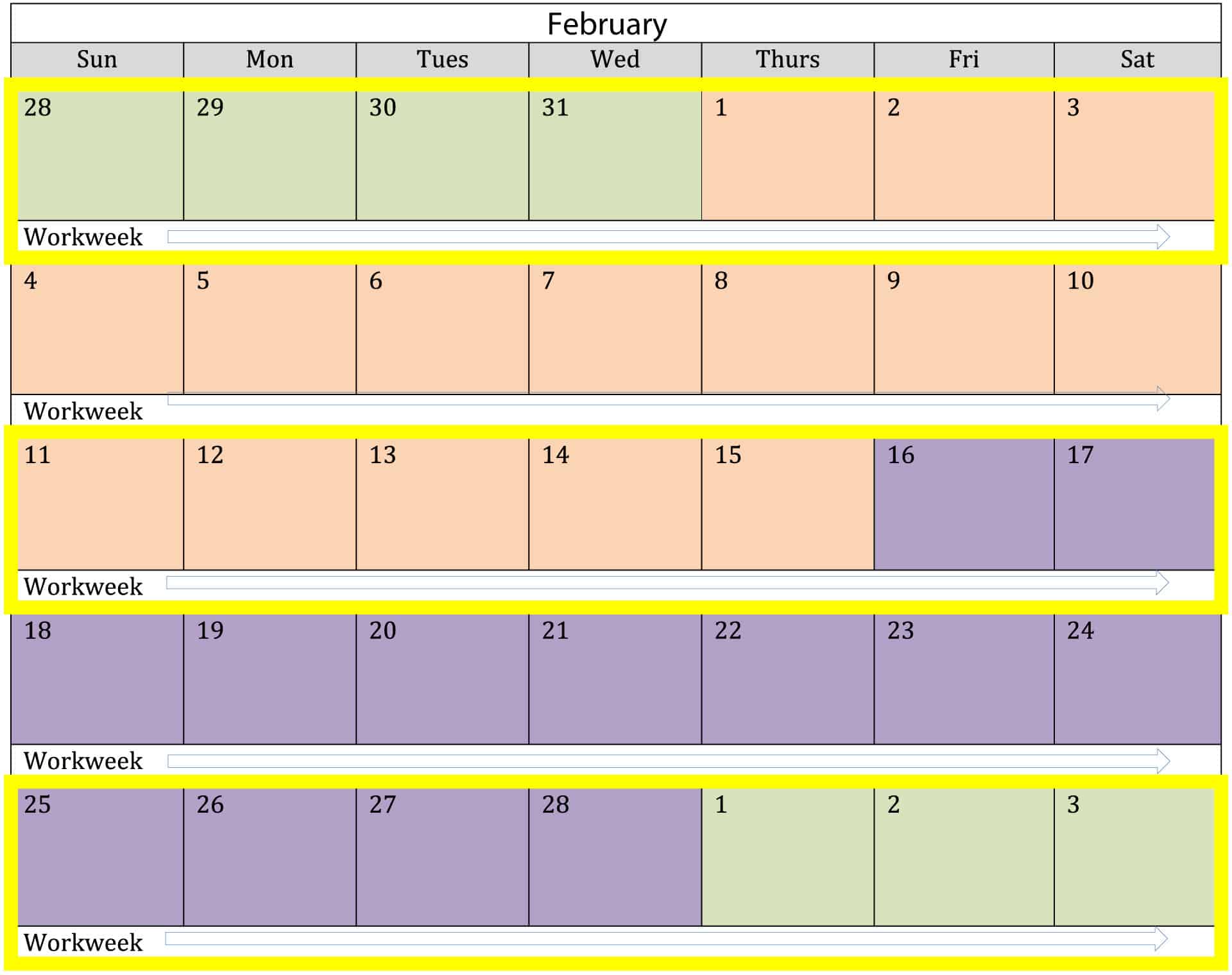

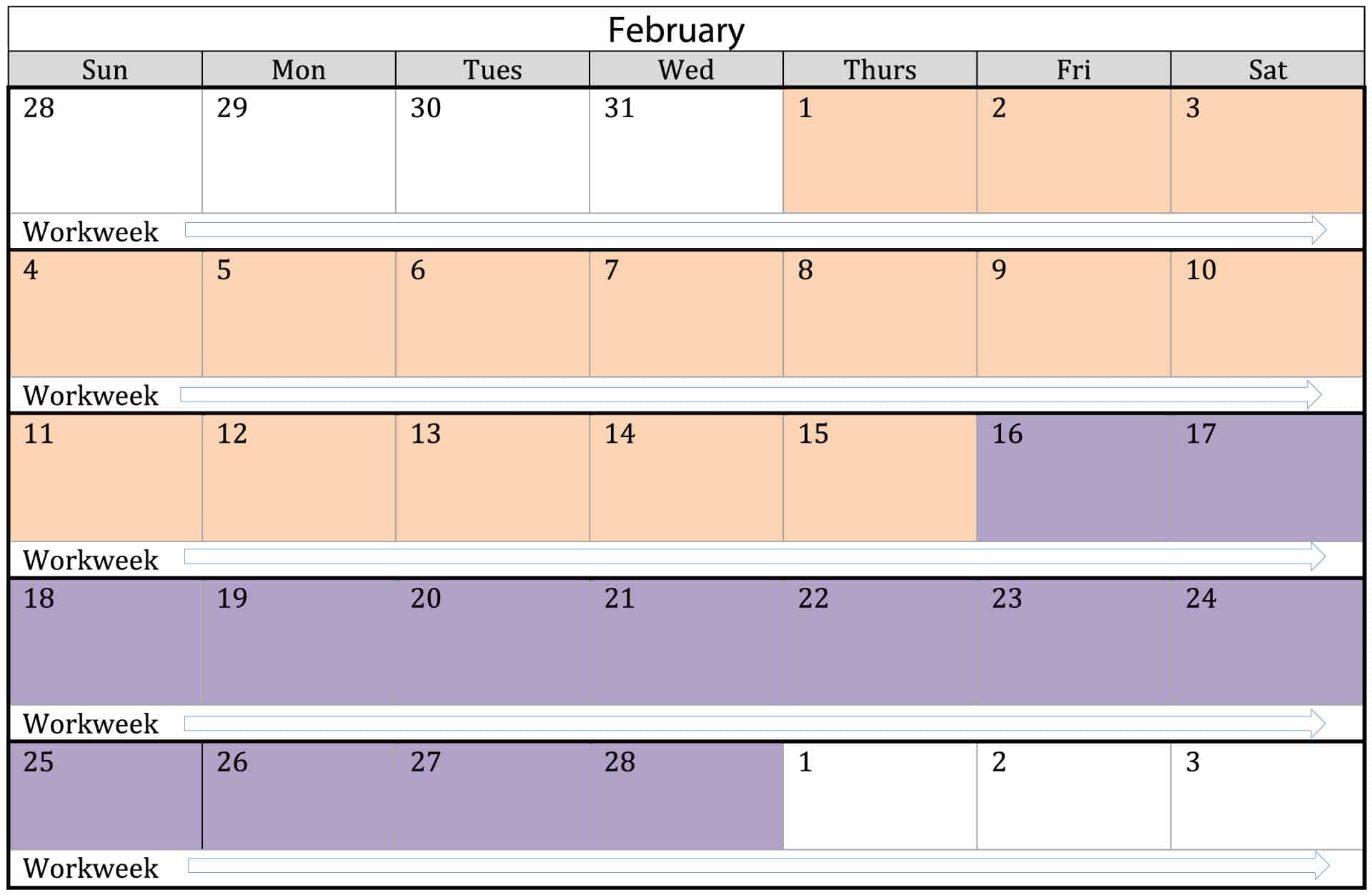

All Services Backed by Tax Guarantee. Multiply gross pay for one bi-weekly pay period by 26 to get the annual salary. The Addition of the Second Workweek.

Find 10 Best Payroll Services Systems 2022. All inclusive payroll processing services for small businesses. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Divide the annual salary by 24 to get the gross pay for one semi-monthly period. Federal Salary Paycheck Calculator.

Anything received after the due. Usage of the Payroll Calculator. Semimonthly payroll for salaried exempt employees is straightforward.

Ad The New Year is the Best Time to Switch to a New Payroll Provider. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

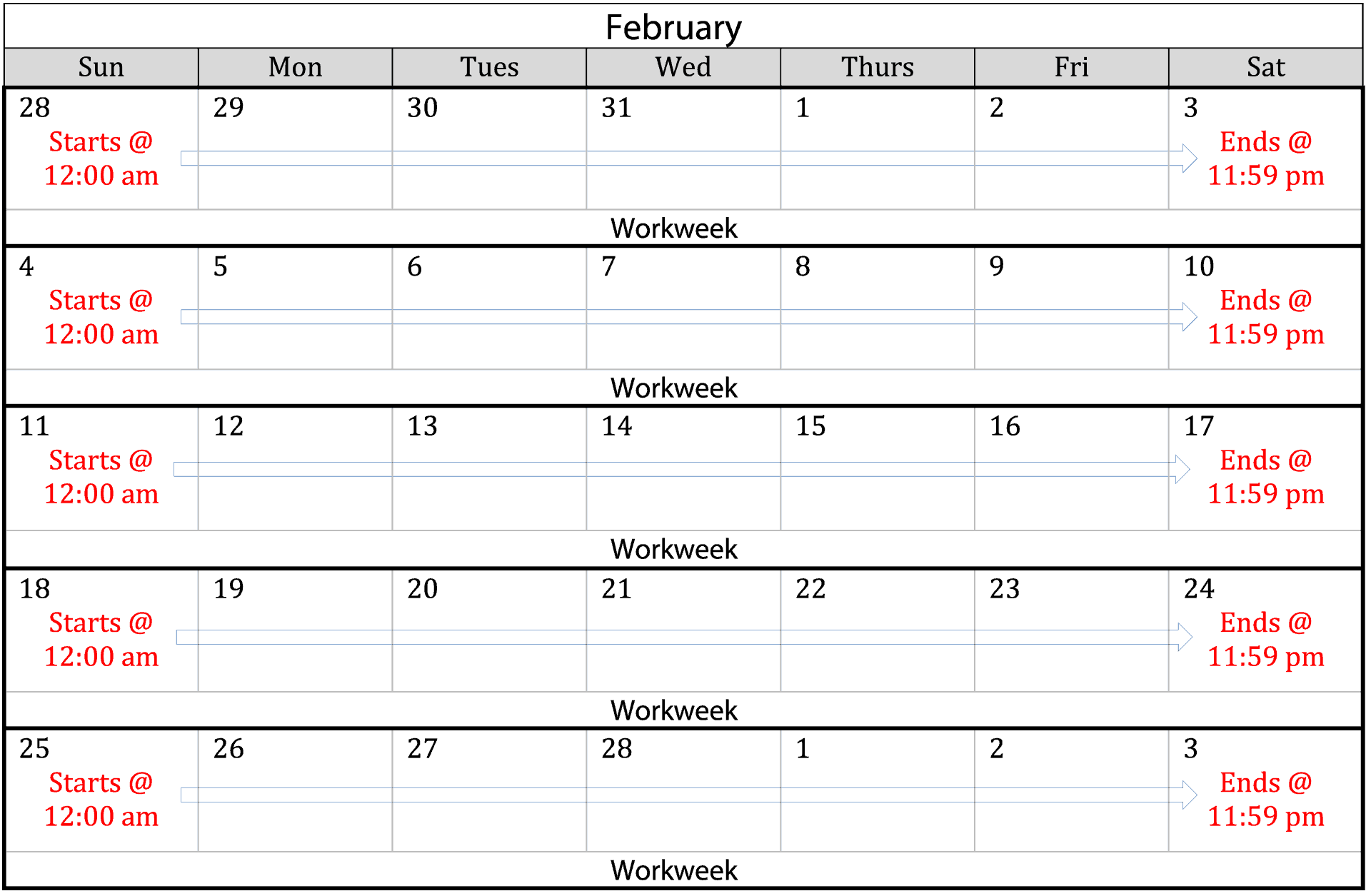

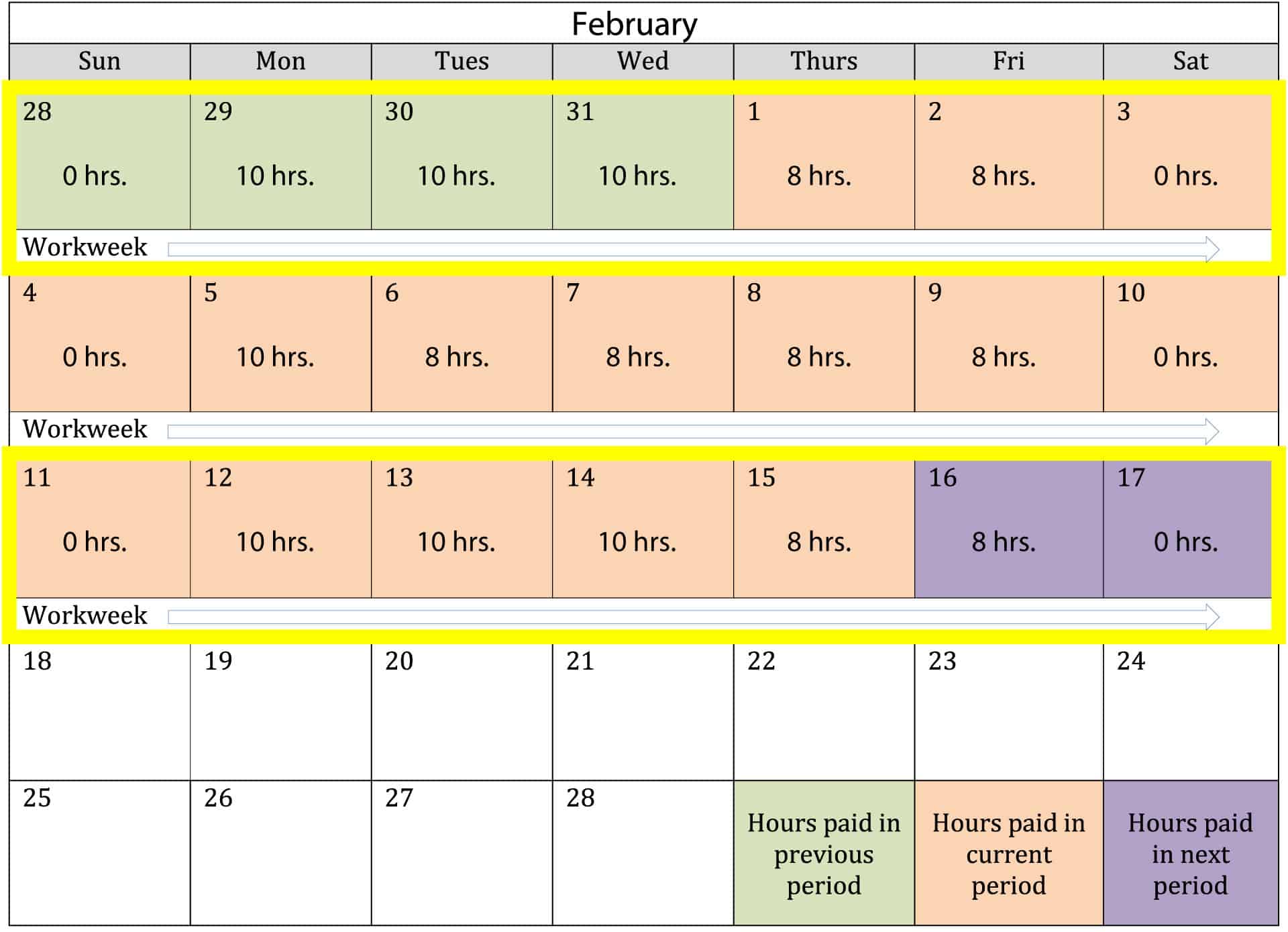

Due to the nature of hourly wages the amount paid is variable. Ad Compare This Years Top 5 Free Payroll Software. Overtime is calculated based on a workweek which is a 7-day period established by your employer.

Ad Looking for semi monthly payroll calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. On a biweekly schedule the employees gross pay per paycheck would be.

To calculate the number of overtime hours worked add the number of hours worked in the second workweek of the pay period and deduct 40 from the. A semi-monthly payroll has 24 pay periods in the year. However semi-monthly pay periods can be confusing when determining.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Paycheck Calculator Take Home Pay Calculator

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Elaws Flsa Overtime Calculator Advisor

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

How To Calculate Retroactive Pay Payroll Management Inc

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes For Your Small Business

Calculation Of Federal Employment Taxes Payroll Services

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Semi Monthly Timesheet Calculator With Overtime Calculations

Calculation Of Federal Employment Taxes Payroll Services

Payroll Formula Step By Step Calculation With Examples

The Pros And Cons Biweekly Vs Semimonthly Payroll

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule